Marketers are struggling to stop brand switching

The rise in digital customer service options has failed to impress consumers as more than half stop using brands over the past year due to poor experiences.

Poor customer service has driven more than half of UK consumers (52%) to stop using a brand over the last year, new research reveals.

The result appears in the latest Global Consumer Pulse study by Accenture, which shows that the proportion of UK customers switching brands last year was virtually unchanged compared to 2013 at 53%.

However, it finds that 61% of people expect to receive a faster service than a year ago while 49% would like to have more options for dealing with brands, including via digital channels. Accenture calculates that the ‘switching economy’, whereby consumers move to new brands as a result of poor service, is worth £210bn in the UK alone.

“We’ve seen the switching metrics increase gradually over the last five or six years,” confirms Joanna Levesque, managing director of sales and customer service at Accenture UK. “There’s no doubt that the trend has been significantly accelerated by the move to digital. It has reduced the barriers to switching and made customers more mobile in more ways than one.”

Consumers are most likely to switch in the retail industry, where 23% of UK shoppers moved from one preferred brand to another last year. This is followed by the utilities, banking and internet service provider sectors, where 13%, 12% and 11% of consumers respectively switched to a new brand in 2014 as a result of poor service.

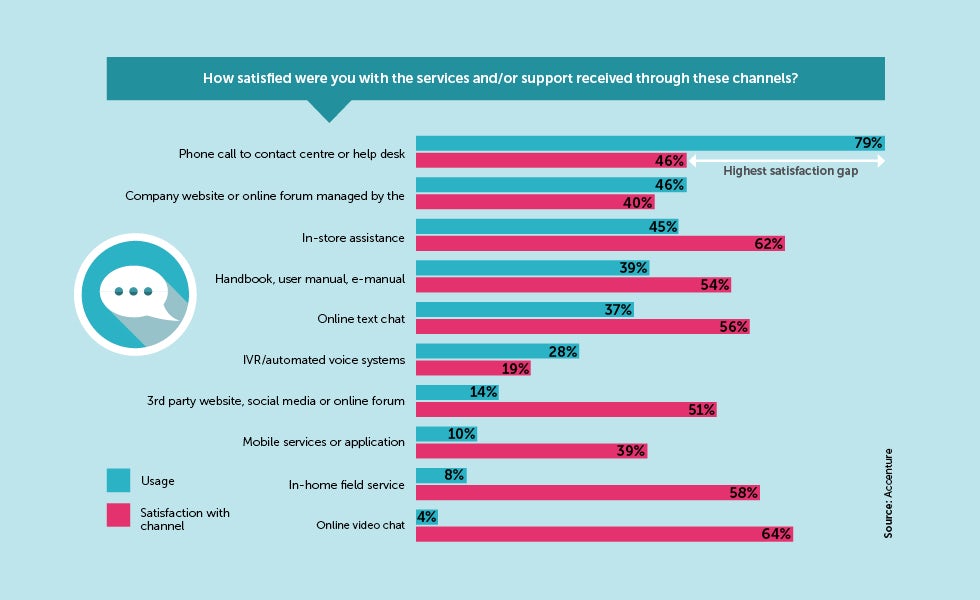

The report finds that 65% of people use at least one online source to receive customer service from brands, although only 40% are satisfied with the support received through a company website. Satisfaction levels improve somewhat when services like online video chat (64% satisfied) or online text chat (54% satisfied) are offered.

The study shows that call centres remain by far the most popular option for customer service, used by 79% of people, but that only 45% of consumers feel satisfied with the support they receive when phoning a brand.

Customers are continuing to turn to call centres as a consequence of brands’ online failings. The research notes that people place the greatest value in dealing with ‘knowledgeable and well informed employees’. This option was selected as very important by 90% of respondents, while 83% attribute high importance to brands that have staff ‘who can deal with my issues without referring further’.

Levesque says: “Part of the reason contact centres are still most popular is that online channels don’t yet deliver the amount of functionality and the richness of interaction that consumers want. We’re seeing that as digital is being enabled, it is not tending to reduce a lot of volumes in contact centres because people are going online first to look for information before turning to the contact centre.”

Much of this online research is now performed via mobile devices, with 56% of people using a smartphone or tablet to access online customer service information in 2014. Last month Google changed its search ranking algorithm to favour mobile-optimised sites in recognition of the fact that consumers increasingly search for company information on their devices.

Mobile is also encouraging people to leave instant feedback about the customer experiences they receive from a brand. Sixty-seven per cent of respondents say they have told another person about a negative experience with a company, while a further 20% have posted comments on a review site. This correlates with the rising influence of online resources like Trustpilot. Forty-four per cent of UK consumers agree that they rely much more on other people’s experiences and reviews to inform their decisions than they did 10 years ago.

“People trust companies less while at the same time trusting their friends or internet reviews more,” says Levesque. “That means that companies can’t trade on their brand reputation to the same extent [that they used to].”

The Accenture study also shows that the proportion of UK consumers who switched brands last year as a consequence of poor service is lower than the global average (52% vs 66%). The company, which surveyed over 23,000 consumers in 33 countries in total, put the global value of the switching economy at $6.2 trillion (£4 trillion) in lost and gained business by brands.

It found that although people are less inclined to switch brands in the UK than they are globally, consumers in this country are less impressed by perceived advances in customer service. For example, while 61% of people globally agree that the increased role of technology has led to significant improvements from the companies they deal with, only 54% make the same assertion in the UK.