Consumers are ‘dirtying’ databases with false details

Privacy concerns and unwanted marketing are the top reasons for consumers giving false information online and with only a small percentage of incorrect responses disproportionately devaluing databases, brands need to up the ante in explaining the benefits of giving accurate data.

People are deliberately giving brands false data about themselves to protect their privacy, and are ignoring brands’ efforts to empower them to take control of their data, according to a study of more than 2,400 UK consumers by research company Verve.

It only takes a relatively small percentage of database entries to be ‘dirty’ before its value disproportionately declines, according to the report. Companies therefore need to up their efforts to encourage people to give the right information.

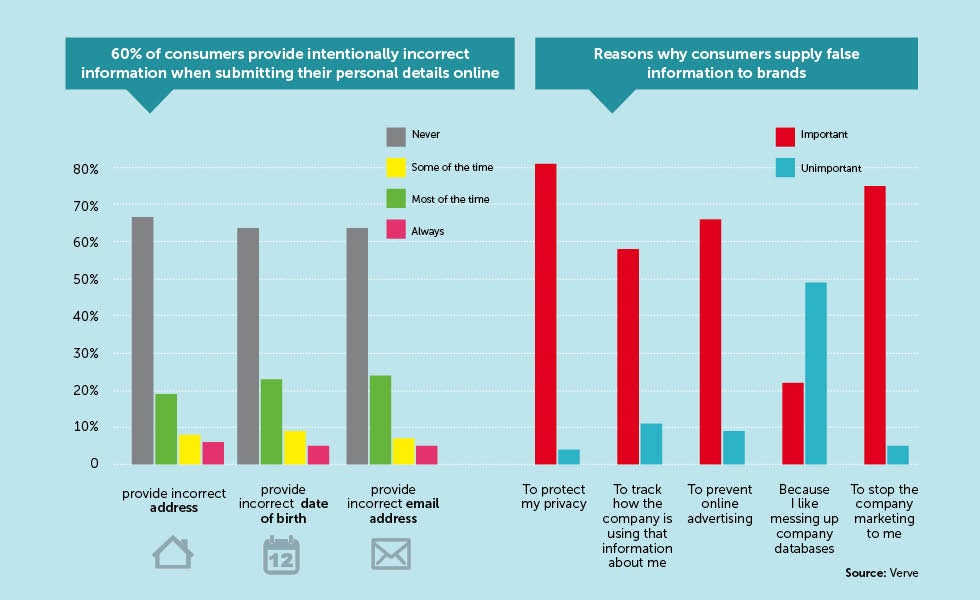

The research shows that 60% of consumers intentionally provide incorrect information when submitting their personal details online. Broken down by the types of data provided, birth dates are the most commonly falsified, as almost a quarter of consumers (23%) give the wrong date of birth to companies ‘some of the time’, 9% do this ‘most of the time’ and 5% ‘always’ give the wrong date.

The research also shows that nearly one-third of people give a fake email address and a made-up name at least some of the time. It is a similar story for incorrect information given about home addresses, phone numbers, job titles and company names.

“The upside of providing information has not been articulated,” says managing director at Verve Colin Strong. “The case is not always made by companies about what consumers

are going to get in return for providing information, but people see the immediate effects of being put on more marketing lists and being pursued by online advertising and email spam.”

The study therefore looks at why people give false data. Privacy concerns top the list with 81% of people saying this is important, while 77% believe that the information being requested is intrusive and 76% say it is unnecessary.

Also high on the list of reasons for lying on forms is to stop companies marketing to them – 75% of consumers say this – and two thirds say their motivation for giving false information

is to prevent online advertising. Malice towards companies and embarrassment about having internet browsing behaviour tracked are less common reasons.

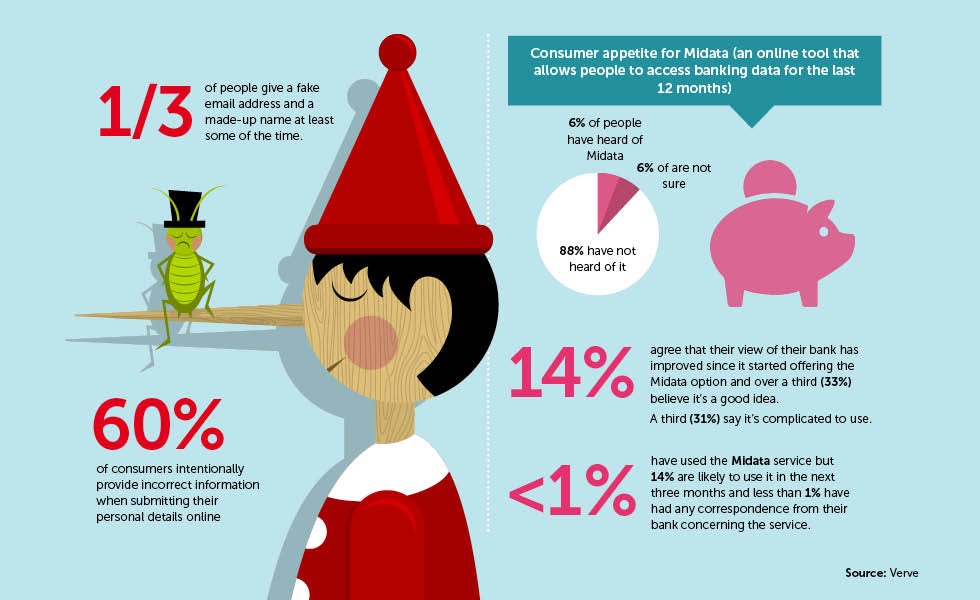

Meanwhile, another study, also by Verve, looks at consumers appetite for Midata, the government-backed scheme tasked with giving consumers access to their personal data which is held by companies such as banks and energy providers. For example, current accounts now make transactional data for the previous 12 months available to download as a single file from online banking websites.

Although it is a form of consumer empowerment, the awareness is low. Only 6% of people have heard of Midata, 6% are not sure and 88% state they have not heard of it. In addition, the stats show that less than 1% say they have used their bank’s Midata service, while 14% are likely to use it in the next three months and less than 1% say they have had any correspondence from their bank about it.

However, there are positive signs for engagement as 14% agree that their view of their bank has improved since it started offering the Midata option and over a third (33%) believe it is a good idea.

Strong says: “With Midata there is a greater opportunity for consumers to recognise what kind of data is available and how it can be used to good effect.”

Consumers also show some interest in what they can use the data for, as 15% agree that they intend to upload the Midata information to a price comparison site in order to get the best banking deal and 14% agree that they intend to upload the information to apps that help them with their finances.

However, many consumers question using the information to get better deals, with 39% agreeing that there is little value in using Midata information to compare bank accounts. Almost a third (31%) say it is complicated to use and 68% agree that they are uncomfortable sharing banking data with third parties such as comparison sites.

“There is a danger of missed opportunity around all of this,” adds Strong. “Banks and mutuals [such as building societies] could help vulnerable consumers, who could do with more guidance and tools to assist the way they manage their finances. It is in their interest to develop propositions in collaboration with consumers.”