Benchmark your social media

Most marketers will spend more on social media this year than last, yet few claim to know what they really get for their money. In response, the CIM is creating a testing ground with benchmarks for the industry to measure and share campaign success. Here, brands kick off the dialogue with their own experiences.

- O2’s head of social media gives his opinion on the value of the social web

- Burberry has no problem in investing in social media, click here to see why

- How does LinkedIn think it can improve your business? The social network’s director for marketing solutions tells all here

- What other social media sites are brands using? Click here to find out

Many businesses are bullish in their commitment to digital marketing, convinced that it’s a cost-effective way of marketing their products and services. Three-quarters say they will spend more money on social media this year compared with 2011, according to The Chartered Institute of Marketing (CIM).

Procter & Gamble is one of those dedicated to the digital approach, to the extent that it has restructured its marketing team in the belief that social media is a major force. Similarly, Reckitt Benckiser is selling a new Cillit Bang cleaning product solely through Facebook, in line with its vision of a future where social media, sales and marketing are more integrated.

Because more brands are turning to the social media space, convinced that it can yield a cost-effective return on investment, the CIM has undertaken a major benchmarking study, with the aim of helping marketers to measure their campaign’s success against its industry standard.

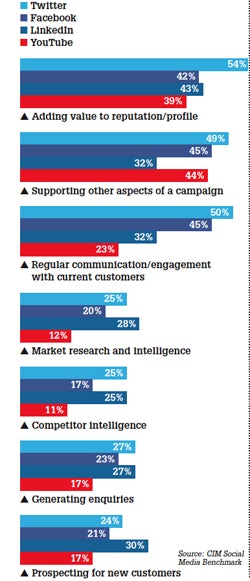

The report, shown exclusively to Marketing Week, to coincide with Social Media Week, has analysed the four major digital platforms to see which ones marketers are getting the most success from. Facebook is the most successful with 16% of businesses seeing a return on their investment. This compares with 15% for Twitter and LinkedIn and 9% for YouTube.

Half of the 900 UK marketers questioned by the CIM see potential in social media, saying it will be a significant force in five years’ time. But for the moment, many aren’t seeing results.

Nearly a quarter say their activity on Twitter was not at all effective last year, a third say the same for Facebook, 37% for LinkedIn and 44% for YouTube.

According to Graeme Boyd, social marketing manager for Xbox EMEA, this will be the year that marketers will spend their money on this type of media carefully – and will be measuring its effects. In order to monitor the success of a campaign against the current industry standard, tracking must be put in place.

“The days of throwing thousands of pounds at snazzy but unvisited Facebook apps or dropping support for your existing digital touchpoints because social media is ‘what everyone’s doing’, should be over,” says Boyd.

Xbox is tracking data points across its YouTube pages and Facebook channels, setting targets and benchmarks for each. From this, Boyd will be able to put together a picture of success and begin building an ROI model.

“By measuring our earned media [free ‘media’ from consumers advocating or talking about a brand] against the costs of paid media, we can start to see a clear benefit – expressed in a cash value – from our social media work,” he says.

Xbox, which works with the media agency UM, uses Facebook and YouTube for content creation and to talk to fans, and tends to use Twitter for customer queries via @XboxSupport. It is testing customer-to-customer support, where its most loyal and knowledgeable users can give other people advice.

For the CIM’s head of insights Thomas Brown, having a clear financial understanding of what these platforms can do for a business is the first step to convincing leaders to invest.

“There’s little point in going to the board and jumping up and down about fans and followers and retweets if they don’t understand what it all actually means. Marketers need to turn these buzzwords into something that is meaningful for the wider business.”

Last November, Adobe launched a tool to help analyse the monetary value of these platforms, called SocialAnalytics, which it claims is particularly useful when looking at Facebook ‘likes’. It helps to measure the effect of platforms on a customer’s buying decision.

Setting achievement metrics that work towards achieving or exceeding the current industry standard set out by the CIM will also help to convince those at higher levels that digital is right for your business.

Marketing Week columnist Mark Ritson, often outspoken about the effectiveness of social media methods, agrees that the rules of return on investment should apply to these newer forms of communication just as they do to traditional platforms. He says marketers should be asking themselves what the objective of the campaign is – is it awareness building, changing brand associations, lead conversion or sales? Who is the target audience? And what is the current benchmark achieved and your goal compared with this?

Answering these questions should help avoid the ‘digital waste’ that has been created, according to a TNS study, which shows that 61% of consumers do not want to engage with brands via social media.

Yet it is clear that some do. Burberry, for example, has 10 million ‘likes’ on Facebook and launched its perfume, Body, through the network (see case study, below). However, having people who like your brand is one thing, measuring whether or not they are engaging with it is another.

One way of measuring the effect of a Facebook campaign is to look at the overall engagement by consumers, proportional to the fan base, which is a benchmark O2 uses. A basic way of doing this is to add up all the likes, shares and comments on a brand’s status update over a defined period of time, and divide that by the number of fans.

“This is led by sector, but if you are achieving above about a 2% engagement ratio, you are generally doing a pretty good job. Past 5% is very good,” says Alex Pearmain, head of social media at O2 UK (see Q&A, below). “It’s not difficult to acquire more fans through ad spend if that is what you are after. The challenge is keeping them engaged when you get them there.”

Some brands are clearly doing well at integrating social media into their overall marketing strategies. But convincing management this is the right thing to do can be tricky. Phones4U head of social media Jeremy Waite says his board originally didn’t buy into social media because of ‘fluffy metrics’.

Indeed, 30% of marketers ‘strongly disagree’ that their management understands why their brand is investing in Facebook, 28% say the same for Twitter, 27% for YouTube and 22% for LinkedIn, according to the CIM. On the plus side, more than a third of respondents ‘strongly agree’ that leaders understand investing in LinkedIn (see below).

Waite says Phones4U moved the management of social media out of marketing and into the e-commerce team to give it a more commercial angle. Speaking at Marketing Week’s Digital Strategy summit last month, he said: “We set up a social community management team in the e-commerce division. That team tracks clickthroughs and cost of acquisition. Social is now discussed commercially in the same way as paid search.”

Facebook has often drawn attention to how Burberry uses its pages to promote its perfume to fans of the designer label

Convincing the whole business to be engaged in your digital strategy is the only way to make money from any investment in this area, argues Ken McMeikan, chief executive of Greggs. “Social media will make you money if you act upon what your customers are telling you. That is not just as a marketing team, that is the whole business acting on it,” he says.

The leadership team at the UK’s biggest baker discusses feedback from social networks every week, something that McMeikan calls “one of the most powerful tools for a chief executive, giving a greater sense of what is really happening in your business”.

“[Social] gives you what is on the customer’s mind in real time. If you have a business that is agile enough to reply and do something about it, you will have a growth business,” he says.

Yet even if a business isn’t using social to its full effect yet, Russ Shaw, former Telefonica marketing director and general manager at Skype, says it is worth experimenting – as 28% of marketers say they are doing. “These channels are very new. My advice would be keep trying. Some things are not going to work, they are going to be a disaster, but some things will.

“Build on your learnings and what is working. Understand how these channels then relate to the specific audience you are trying to reach.”

Measuring results against the CIM’s industry standard could be a good place to start learning about and understanding a brand’s social media efforts. That way, you can assess whether you are going in the right direction with your digital strategy.

Q&A

Alex Pearmain

Head of social media

O2 UK

Marketing Week (MW): Marketers are not yet finding social media effective and it is seen as an experiment, according to CIM research. What’s your reaction to this?

Alex Pearmain (AP): I’m not surprised people aren’t making money out of it. Digital marketing is typically measured by looking at where the last click came

from, or for more traditional marketing, you’d look at brand-led metrics. Revenue is very difficult to attribute to social media. There isn’t yet a sophisticated enough understanding and application of measurement processes to do that.

MW: Where would you say O2 is in terms of its social media strategy?

AP: Having a single ‘strategy’ for social media is quite difficult because it effects so many different customer touchpoints and so many parts of the business. Unless you are the chief executive, no single person can totally direct social media for a business.

My role is setting the overall direction and empowering colleagues to make the most of it. In some areas, our content strategy is very well developed. That might be embracing our customers’ nostalgia about mobile phones on Facebook [when conversation turned to the 10 year anniversary of the brand] through to customer engagement on Twitter about new product development.

I want to integrate social media with our products and services. So in this year’s January sale, people could create a poll with their Facebook friends and ask them which handset they should buy. We know that customers take advice from friends, so this made it easier for them.

MW: What’s the point of social media if it can’t make money?

AP: Social media can make money, but businesses need to have a broader view of how it can do this. If someone invests in direct response and wants a return within 10 days, I would query the use of social media.

However, if it is a longer-term approach to drive customer engagement and customer value, then social media is more appropriate.

MW: How can a marketer persuade management to invest in social media?

AP: Don’t shove the youngest guy in the room in front of them and say “we must do it because it is what the kids are doing”. Marketers need to present social media marketing as part of an overall integrated marketing strategy.

Case study: Burberry

Putting a value on social media

Burberry is willing to spend serious cash on digital marketing because it believes that by using the medium creatively it can attract future customers.

The fashion business spends 60% of its marketing budget on digital channels. While Burberry does not peg its social media activity directly to sales, its chief executive Angela Ahrendts attributed strong financial results to “continued investment in innovative design, digital marketing and retail strategies” when it released its first half results in 2011.

Indeed social media was at the heart of the launch of its fragrance Body last summer. Most of the luxury brand’s marketing budget was used to promote the perfume through Facebook. Samples were mailed to 250,000 of its 10 million ‘likers’ in return for customer details. Any comments or likes on the branded page were shared with users’ friends to spread the word that the perfume can be purchased in stores or through its website.

Facebook has often drawn attention to how Burberry uses its pages to promote its perfume to fans of the designer label. The luxury brand was credited in the social network’s initial public offering a few weeks ago to demonstrate that businesses are using the site for major product launches.

This use of social media has helped Burberry get to number one of thinktank L2’s digital fashion index, which has called the label an ‘icon’ that has proven digital investments translate into shareholder value – in Burberry’s case, a 29% increase in revenue for the six months to 30 September 2011 to £830m and pre-tax profits up 26% at £162m.

As well as its Facebook page (Burberry is the most popular luxury fashion brand on the site), the brand’s digital and social activities include a Twitter stream with 750,000 followers and an Instagram page to show its 173,000 followers behind-the-scenes pictures. Burberry used Twitter for its ‘Tweetwalk’ last September, where it showed pictures of clothes from its forthcoming collections – just before they were unveiled to the fashion editors sitting beside the catwalk. It also uses microblogging site Sina Weibo in China and music network Douban.

Meanwhile, its ‘Art of the Trench’ website encourages people to upload pictures of themselves wearing a Burberry trench coat.

To do this, they must be signed into Facebook and allow the Art of the Trench application to access user information and post on individuals’ walls via Facebook Connect. This means that Burberry can see some information on who is engaging with the brand.

LinkedIn: how it can be used to improve business

Marketers may be good at building their own list of contacts on LinkedIn, but few seem to be making the most of their brands’ LinkedIn accounts, despite the network having 150 million members worldwide. Only about a quarter say they regularly update their brand’s group pages, and only 14% say they provide information on them weekly or more often, according to CIM’s research.

About a third of marketers say they are just experimenting with the site and 37% say their marketing efforts through the network were not at all effective. This compares with 33% who say Facebook didn’t get results last year and 44% who weren’t happy with YouTube.

LinkedIn director for marketing solutions EMEA Josh Graff isn’t surprised that brands are still trying to work out how best to use it. He says: “This is reflective of our experience in 2011. There were some amazing success stories, but in some incidences marketers were doing it for the sake of it. For me, 2012 is the coming of age, that transitional year when marketers start to take a far more strategic approach to social.”

The best way to use LinkedIn is clearly in a business-to-business context. People generally follow two or three brands in their sector, so there is an opportunity for these businesses to build up advocates, says Graff.

HP created a group on the site to help change perceptions among smaller businesses that it supplied IT hardware only to large organisations. The business worked with LinkedIn to build a community of 6,000 members, by using the data the network has on professionals around the globe to target them at scale.

Group members are now 20% more likely to recommend HP and 75% repeatedly visit the group, according to the business network. “HP also saw a rise in metrics across its other social media which it directly attributed to its LinkedIn activity,” claims Graff.

He also says that niche groups can target people more effectively. He gives the example of Philips, which wanted to target people working in radiology and cardiology to help position it as an expert in the industry. Graff says doing this would have been more difficult through other networks and the group – Innovations in Health – now has 38,000 members.

Brands can also run polls targeted at specific groups. One is currently asking whether red tape is hindering innovation. Prime minister David Cameron has written a blog on the site linked to this, part of his Red Tape Challenge, encouraging business people to give feedback on regulations.

For Russ Shaw, former Telefonica marketing director and general manager at Skype, LinkedIn is an effective route: “It is a low-cost, easy-to-use channel that can reach a lot of people.”

Smaller social sites – and how businesses are using them

The photo-sharing network links to Twitter and Facebook and includes filters for people to show pictures to their friends. Brands are also using it, including Red Bull, which has nearly 1,000 followers, compared to its @redbull Twitter account with nearly half a million.

GetGlue

A social network based around entertainment, where users collect virtual – and physical – stickers for responding to content on the site. Brands such as MTV use it for talking about its programmes such as reality show Geordie Shore, and users can check in for exclusive video streaming, coupons and downloads. Pepsi partnered with the site during this month’s Super Bowl. Users could get video content and buy-one-get-one-free vouchers.

![]()

Nimble

Combines social media with CRM (customer relationship management), keeping users’ email, calendar, social and business networks in one place. When a business user contacts someone, it shows all previous communication, plus what the other person is doing on Facebook, Twitter and LinkedIn.

PeerIndex

Measures someone’s social influence, based on their activity and following on social media sites, which is presented as a score out of 100. Influential people can be given rewards by brands. Brands can use it to identify influencers or ‘opinion leaders’.

Calls itself a virtual pinboard, where users can ‘pin’ their favourite pictures, recipes, clothing or quotes to share with others. It can be used for work purposes – where people can save references all in one place. While it isn’t yet open to brands to build profiles, a report published earlier this month by Mashable.com shows it drives more traffic to third-party websites than Google+, LinkedIn and YouTube combined.