How marketers can dodge the dangers of deflation

Three ways marketers can grow brand equity in the face of unprecedented price drops

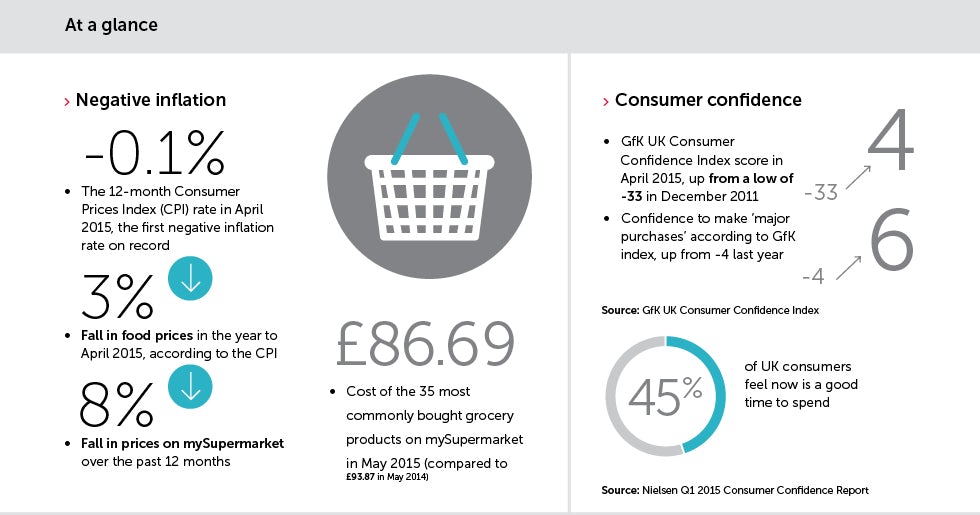

When it comes to price, how low is too low? In April, the UK’s consumer price index (CPI) inflation measure turned negative for the first time on record, with prices 0.1% lower than a year previously. That followed two consecutive months of zero inflation.

So does this add further pressure to brands that have already been forced to slash prices in the wake of the recession in an effort to attract value-driven consumers?

The shift to negative inflation means that a basket of goods and services that cost £100 in April 2014 cost £99.90 a year later. It follows a steady fall in CPI inflation since 2011 and, although this measure has been in use only since 1996, it is thought to be the first time prices have dropped across the board since 1960.

Despite its historic significance, economists generally expressed little alarm about the downward inflationary trend. Bank of England governor Mark Carney described it as a temporary blip that would be rectified by the end of the year, while the chancellor George Osborne argued that “negative inflation is not damaging deflation”. Instead, he suggested that falling prices would be a boon for the economy by providing families with more money to spend.

It is true that consumer confidence has tentatively risen over the past year, reaching pre-recession levels again, but few marketers are likely to celebrate the onset of negative inflation. Price depression has dogged a huge range of companies by eating into margins, reducing brand value and encouraging brand switching among consumers.

How, then, can marketers meet the demand for low prices while maintaining their brands’ emotional benefits and their differentiation in the marketplace? Is discounting an unsustainable strategy in the long term or do marketers need to reassess how they communicate their brand’s value proposition?

We present three tips for marketers seeking to adapt to the new phenomenon of negative inflation.

1. Regain trust in your pricing

Figures provided by mySupermarket, an online shopping and comparison site, show an 8% drop in supermarket prices over the past year: a much more dramatic fall when compared to the 0.1% annualised drop in CPI inflation.

The site, which lists the price of goods from 11 major retailers including Aldi and the ‘big four’ supermarkets – Tesco, Sainsbury’s, Asda and Morrisons – found that the cost of its 35 most commonly bought grocery products was £86.69 in May 2015, down from £93.87 12 months earlier.

Kim Ludlow, UK managing director at mySupermarket, believes that consumers are “following the value”, rather than particular brands (see Q&A, bottom of page). This is contributing to the downward pressure on prices as the major supermarkets fight an ongoing price war.

“From price- and brand-matches to ‘everyday low prices’, each supermarket wants to look like it is offering the best value and this isn’t going to go away,” she notes. “Shoppers are voting with their feet and continue to swap from the more established supermarkets to the discounters.”

Although price-cutting has become one of the primary tools for retailers seeking to claw back market share, there are concerns about the long-term sustainability of the strategy. Speaking to Marketing Week last month, Asda’s chief customer officer Barry Williams argued that the big supermarket groups have become overly preoccupied with competing on price and have sacrificed their relationships with customers as a result.

“Price will remain a focus in our marketing but we want to communicate that our value stretches beyond price and into quality, technology and the in-store experience as well,” he said.

The comments echoed those of Morrisons chairman Andrew Higginson, who suggested earlier this year that “the big four’s price-focused, ‘we’re cheapest’ ads haven’t truly spoken to the customer but only to one another”.

Aggressive discount strategies are also eroding trust between shoppers and retailers, according to a recent investigation by consumer rights group Which?. It alleges that Asda, Morrisons, Sainsbury’s and Tesco, as well as health retailers Boots and Superdrug, are guilty of running misleading special offers that breach government guidelines.

This includes comparing prices on the same product that refer to different periods of time, thereby giving the wrong impression about a discount. Which? uses the example of a pack of Wall’s sausages, which were on sale for £2.74 in Morrisons for 42 days, then reduced to £2 and marked for 49 days as ‘was £2.74’.

In such cases, Which? argues that the lower discount price is a more accurate reflection of the value of the product because it has been available for longer and that quoting the previous ‘was’ price is misleading.

Which? has lodged a super-complaint about such pricing practices to the Competition and Markets Authority (CMA), though the British Retail Consortium has denied that retailers are misleading customers. “The examples set out are very specific in nature and are not in any way indicative of broader systemic problems across the retail industry,” it says.

Meanwhile, customer engagement agency Grass Roots has added its voice to those who claim that extensive discounting is an unsustainable strategy because it erodes consumer trust.

Divisional director for promotions and incentives Ian Horsham says: “Dropping prices can plant a seed of doubt and accrue distrust over time as customers may start to suspect they have overpaid previously. Reductions should be utilised only as a short-term approach for selling longstanding inventory or time-sensitive merchandise.”

2. Harness growing consumer confidence

Although falling prices should help to increase consumers’ spending power, there are concerns that negative inflation could also lead shoppers to delay making ‘big ticket’ purchases, such as cars or white goods, in the expectation that prices will tumble further.

Peter Allibon, sales director at car marque Mazda, acknowledges this is one possible outcome, but is doubtful about the extent to which it will play out in the market. “The media may have put a thought in people’s minds that inflation is negative and therefore big ticket items may come down,” he says.

“But the reality is that whenever prices increase or decrease [in the automotive sector], it’s very negligible in terms of the overall value of a car. It’s dependent on many factors and negative inflation isn’t that significant within that.”

Allibon notes that consumer confidence levels are relatively high in the UK and that people are currently more disposed towards making a car purchase than they have been in recent years. “The automotive sector is very much based around salaries and house prices,” he says.

“Salaries are starting to increase after a prolonged period when they were flat or even going down. That and house price increases are the things that give people the confidence to know that their affordability is not a short-lived thing and they can make a decision to buy a new car.”

Rather than slash prices since the recession, Mazda has sought to match its offer to consumers’ squeezed budgets by developing its range of finance packages. This includes offering zero deposit deals on more of its models, whereby the car is not owned until the buyer has completed all the payments over the term of the contract.

This approach enables Mazda to avoid debasing the price of its product while simultaneously growing brand loyalty by establishing a long-term finance arrangement. Allibon says that under these deals, consumers are more likely to stick with the brand when they trade in a car.

“By focusing on attractive finance offers, car manufacturers have actually drawn people who may have traditionally been cash buyers into recognising a car as a monthly expense, as opposed to a one-off purchase they make every three or five years,” he says. “That creates more opportunity for renewal.”

The growth of finance offers since the recession extends to other sectors, including white goods and home appliances, and has helped to buttress consumer confidence. Having dipped to as low as -33 in December 2011, the UK Consumer Confidence Index by market research group GfK moved out of negative territory in May 2014 and has recorded six positive scores over the past year. The index score for April 2015 was 4, though this surprisingly slipped back three points in the latest May figures.

Nielsen’s comparable measure recorded its eighth consecutive quarter of growth in the first three months of this year, with 45% of people saying now is a good time to spend, the highest since 2006.

The trend coincides with the upturn in the economy and the news from earlier this year that wage increases have finally caught up with inflation. Nick Moon, managing director of social research at GfK, says the shift to negative inflation is likely to have a positive effect on consumer confidence as prices fall and disposable incomes improve.

He also predicts that only a small minority of people are likely to put off buying big ticket items as a result of negative inflation. “People are generally not good at delayed gratification,” he says.

3. Present a breadth of price points

The rapid growth of deep discounters such as Poundland, Lidl and Aldi has altered how consumers perceive the entire concept of value in the wake of the recession. As the parameters of what constitutes ‘cheap’ have shifted downwards, brands have been forced to reassess their value proposition and how they communicate their price points to customers – particularly as negative inflation indicates prices being driven down further.

Burger King is one brand seeking to change perceptions about its prices. The fast food chain has this year been running a TV campaign in the UK in which a man is seen asking passers-by to ‘take a guess’ about how much a Burger King meal costs. The campaign shows people making their guess before a lower price is unveiled.

Matthew Bresnahan, global marketing director at Burger King, explains that the campaign was borne out of research by the burger chain that showed consumers were not aware of its cheaper options. “We kept hearing this perception that we didn’t have an entry level menu and that all of our meals costs £6,” he says.

“We found that by using real people and their real responses to the question ‘how much would you pay for this meal?’ we could really get the message across about our meal deals and saver menu.”

Bresnahan adds that Burger King is focused on presenting its multi-tiered pricing structure more clearly. This includes higher-priced premium burgers, as well as its value range.

“We have found that the more we’ve talked about our value-for-money options, the more [sales of] the premium items have increased, because we’ve had more people coming in for those value options and then trading up,” he explains.

The success of retailers such as Waitrose and Marks & Spencer’s food business is proof that people are willing to pay a premium where they feel they are getting good value for money. The challenge for marketers is to communicate product quality, price differentiation and the overall brand promise clearly at a time when negative inflation is adding to the perception of

falling prices.

This was M&S CEO Marc Bolland’s message when announcing a 3.4% annual uplift in food sales last month. “This was an outstanding year in a difficult market,” he said. “Why have we outperformed? Through a positioning we took four and a half years ago, a strategy to step away from the supermarket territory.”

Rather than price, “quality and innovation” are the two pillars Bolland identifies in what he calls M&S’s “specialist” strategy. They are attributes that many more price-focused brands would perhaps do better to strengthen.

Q. Do you get the sense that the big supermarkets are struggling to hold their prices at a sustainable level?

I think that on any given day any supermarket can be ‘the cheapest’. It comes down to the mix of goods and promotions on offer. That said, I think that shoppers are savvier than ever and are researching purchases before they buy – that means that all the supermarkets must continue to offer value to shoppers in the categories where they want it.

Q. Does price cutting tend to result in a big uplift in sales for retailers?

We can see a general trend of falling prices driving a sales uplift. Promotions definitely do drive sales online at mySupermarket – though the promotion and the product are important when it comes to how much of an uplift there is.

It is difficult to say what the overall sales uplifts for the retailers are across all of their shopping platform, but it’s clear that being aggressive on pricing strategy is not going away any time soon. You can pick up any paper on any day of the week and see new announcements about supermarkets slashing prices to win back shoppers – that says to me that they believe price cutting is the right decision.

Q. Do you agree that consumers’ loyalty to individual supermarket brands is on the wane as a consequence of the price war?

We see mySupermarket monthly shoppers researching many stores when they are using our site and mobile app. This indicates they are building a selection of lists to use at multiple retailers. It might be cheaper to buy fresh fruit and vegetables at one, but the other may have a really great deal on wine for the weekend. Shoppers are now following the value and seem to be happy to swap stores in search of it.