Facebook vs YouTube: who will win the video battle?

Facebook’s move to trial revenue sharing with video creators will make the platform more attractive for brands as the social network attacks YouTube’s market leading position.

Facebook last night (1 July) unveiled plans for a ‘suggested videos’ feature. When users tap on a video in their news feed, the site will show additional video suggestions underneath interspersed with ads.

These will be similar to the video already being watched – for example on the same topic or from the same publisher. The tool is currently being trialled on a small number of US iPhone users.

Facebook plans to monetise the test by sharing 55% of the revenue from ads that appear in the suggested videos feed. The share will be based on how much time a user spent with each video.

“We’re running a new suggested videos test, which helps people discover more videos similar to the ones they enjoy. Within suggested videos, we are running a monetisation test where we will show feed-style video ads and share revenue with a group of media companies and video creators,” says a Facebook spokeswoman.

Facebook’s growing impact in video

The move is the latest from Facebook as it ups its focus on the lucrative video market. Earlier this week it introduced new analytics for video, allowing publishers to better track performance by making data more accessible and offering more detailed breakdowns for example organic vs. paid or auto-play vs click-to-play.

Speaking to Re/code about the new video revenue model, Facebook’s VP of partnerships Dan Rose said: “A lot of [our partners] have said this will be a big motivation to start publishing a lot more video content to Facebook. That’s exactly what we’re hoping for.”

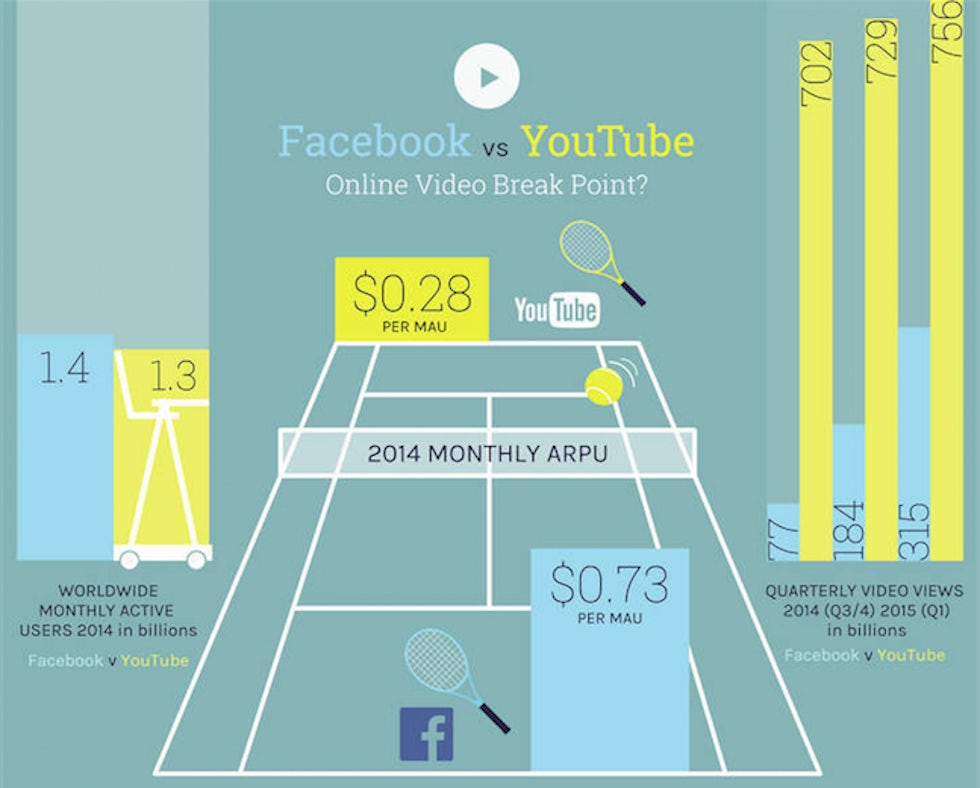

A report from Ampere Analysis predicts that Facebook is catching up with YouTube for video views. It expects Facebook will exceed two trillion videos this year, equal to two-thirds of YouTube’s projected total.

Separate data from SocialBakers found that brands are increasingly uploading videos to Facebook directly, rather than relying on YouTube embeds. During the Christmas period, brands posted 20,000 more videos to Facebook than they did YouTube.

That compared to a year previously, when brands posted more than double the amount of videos to YouTube than they did any other content network.

Facebook vs YouTube

Speaking to Marketing Week for YouTube’s 10th anniversary, the video site’s EMEA boss Ben McOwen Wilson, said competition is good for the site, whether it’s Netflix, Facebook or Amazon Instant.

“Competition is a very good thing for consumers and brands. What remains true for us that competition helps us remember what we need to focus on: that we want to create a platform that allows people to share their piece of content, engage with other people interested in that piece of video better, faster and more easily than they can do anywhere else,” he added.

What makes YouTube different, he explained, is that it doesn’t have autoplay and therefore “doesn’t force [users] to watch anything”.

Nevertheless, Ampere Analysis believes the introduction of a revenue-sharing scheme would elevate it to be a “serious challenger to YouTube’s dominance”.

Adam Reader, senior strategist at LIDA, says the move to incentivise content creators, including brands, should ensure that the most engaging content is found on Facebook first. He also praises the decision to position ads between videos rather than using pre-roll ads as YouTube does.

“Facebook’s unwavering focus on user experience means that it could very well overtake YouTube in the race to be the video platform of choice. Positioning the ads between video content as Facebook plans to go build on the learned conventions of TV advertising and therefore offers a more natural viewing experience for the user,” he says.

“This levels the playing field with YouTube in terms of channel monetisation. This now makes the platform more attractive for brands.”

Steve Parker, managing director, AllTogetherNow.

However Steve Parker, strategy partner at M&C Saatchi, has sounded a note of caution. He says the advantage of YouTube is that it is open to anyone and they don’t need a profile.

He also believes that many content creators are unwilling to cede any more control to Facebook.

“So long as Facebook remains a walled garden it will never pose a serious threat to YouTube. Facebook also won’t attract talent if it continues to treat partners as second rate citizens,” he explains.

Jan Rezab, CEO at SocialBakers, issued a further word of warning this time about the revenue split, questioning how it will work long term – by seconds or percentage of time? Nevertheless he believes YouTube should “watch out”.

“Facebook could now be very serious competition for YouTube in trying to acquire content, communities and possibly event entertainment,” he said.