Marketers fight for more premium video inventory

Video advertising offers higher click-through rates for brands and higher yields for publishers, but the former need to invest more in creating content and the latter in the technology to host it.

For most people, ‘premium’ means something of exceptional quality or of greater value than its competition. With video advertising, there is a frustration among some marketers over

the lack of premium inventory and confusion about what exactly should be classed as must-have ad space.

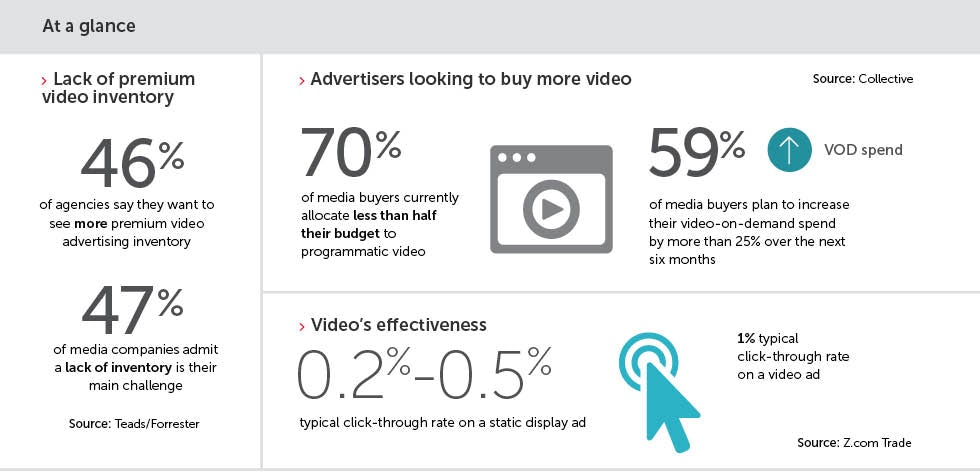

Advertisers desire premium space because they do not want to invest in video and then suffer fraud or poor viewability. According to the recent report ‘Solving Digital Video Advertising’s Premium Dilemma’ by Forrester and ad tech company Teads, future growth in video advertising is dependent on the greater availability of premium inventory – a problem identified by nearly half of agencies.

Many media companies (47%) accept that a lack of inventory is the main challenge they face. Unfortunately, this also means progress is hampered by the cost to brands of placing video ads on media owners’ websites, adding to the cost of producing video content.

Teads’ UK managing director Justin Taylor says the report’s findings reaffirm his thoughts on the state of the digital video ad market. “It costs money to make quality content so you can see why brands use the usual suspects such as YouTube; the premium inventory is just not there,” he says. “Yet video is an area to tap into for publishers because it offers high yields and is a better experience for advertisers and users.”

The definition of ‘premium’

So what qualifies as premium inventory? Usually, it is about the quality of the data the publisher provides to enable a brand to target specific audiences. For advertisers, ‘premium’ means transparency and accountability as well as great content. Yet the Internet Advertising Bureau (IAB) claims that advertisers find the medium confusing. Director of data and industry programmes Steve Chester says marketers see the reach of TV and want to amplify that using online video, particularly with shorter pre-roll ads played before users view content.

“Publishers accept that there is not enough premium pre-roll inventory and that they need to get the content right,” says Chester. “This is a challenging area because there is a limit

to how much advertising you can show before it becomes an interruption.”

He believes advertisers would spend additional money on digital video advertising if there were more premium inventory available. “There is confusion over what is and isn’t premium. Ultimately, it comes down to what works for the brand and what its goals are,” says Chester. “There just needs to be robust measurement.”

Nick Hugh, vice-president and general manager for advertising EMEA at Yahoo, says there are two factors with mobile ads in particular. “First, there is a lack of standard practices around how to target, measure and frequency-cap mobile video ads effectively across devices,” he explains. “This has resulted in advertisers and marketers being cautious, so that mobile inventory supply actually outstripped demand in 2014. This is suppressing costs, keeping CPMs lower than for the desktop.”

The second issue is the open market that the increased demand for online video advertising has created. Hugh says: “This has made publishers reluctant to release their premium inventory to the programmatic buying process. Publishers want to have more control over who buys their video ad space, how much it is sold for and the overall consumer experience. As a consequence, their most valuable asset is missing out on the benefits of programmatic.”

According to online branding company Collective’s 2015 UK Online Video Advertising Market Report, 70% of media buyers allocate less than half their budget to programmatic video. The report, which followed a survey in May of more than 100 media buyers, also confirms that TV and digital buyers are using video in other formats beyond standard pre-roll. Around two-thirds are now buying video in-page, in-banner and within rich media display formats.

In the next six months, 59% of media buyers plan to increase their video-on-demand spend by more than 25%. View-through rate – how often a video is watched through to the end – is considered the top measurement when judging viewer engagement.

One brand investing more in video advertising is Now TV, owned by Sky. Marketing controller Jana Mollett says that since the brand relaunched in March it has embraced video in all its forms. “Even though other media, including radio, can perform strongly, they do not support our main ambitions in the same way as video in terms of engaging with our audience and communicating our messages,” she says. “Now we only buy display formats that host video.”

Mollett adds that Now TV’s proposition to consumers can appear complicated and video advertising allows it to explain the brand benefits simply.

“Regarding premium inventory, you have to be open-minded about what constitutes premium. Ultimately, does it deliver the campaign objective? There are so many ways you can buy inventory. If you are buying programmatically, you can negotiate to guarantee your video will appear around quality content,” she says.

Lack of publisher investment

Another frustration for advertisers is that many publisher websites they want their ads to appear on do not support video ads.

Foreign exchange (FX) trading platform Z.com Trade, which has its headquarters in Japan, recently launched in the UK. To announce its arrival it created a song and music video to lead its campaign. The video was visible in London at underground and mainline train stations and in shopping centres across the country.

“The infrastructure for outdoor video advertising was there in London but it has been more of a challenge online when we tried to advertise on niche FX websites,” says marketing manager Nick Cropper. “The inventory wasn’t there to use video to engage with people so we had to use static banner ads. Click-through rates are between 0.2% to 0.5% on a static ad compared to around 1% for video.”

Cropper understands that publishers have tight budgets but says there needs to be investment in premium inventory for video ads. “In the FX market, the demand is not there yet,” he says. “We will still run the video ads on more mainstream investor sites but the difficulty in reaching niche audiences has made us rethink our investment in video. We have to be pragmatic about what works to reach our specific audience.”

At the Cannes Lions festival last month, digital consultancy Social@Ogilvy and video intelligence software platform Tubular Labs released a report that said marketers need a diverse approach when developing multi-platform video campaigns. This is because every video platform is so different. The report outlines how YouTube and Facebook can deliver large numbers of views, but each has a different ways of getting to the magic number of one million. YouTube provides a slower growth but a higher-quality viewership, for instance.

By understanding the differences between platforms, brands can tailor the creative production and the length and style of the videos for various audiences.

Tips from the report include making the first frame of the video engaging for Facebook because videos are initially auto-played without sound. For YouTube, influential users are critical for driving repeat views and subscribers. However, for premium video Instagram is the place to be.

One prolific user of YouTube is job site Reed.co.uk, which uses it to raise brand awareness and drive traffic to its website. It is a heavy user of YouTube TrueView, which generates impressive viewing figures for the brand among its target audiences.

Marketing director Mark Rhodes explains Reed.co.uk has started to target specific groups to find candidates with specialist skills that its clients need. He accepts that advertising to premium audiences, such as people with particular engineering or tech talents, does push up advertising costs. “You have to consider how effectively any ad format will deliver, whether the creative fits the platform and its audience and what context you are advertising within,” says Rhodes.

Some brands require more robust targeting and measurement tools to be fully convinced of video’s merits, while for many media companies the cost of producing premium video content remains a worry. It seems video remains a work in progress for advertisers and publishers.

Case study: Macmillan

Video advertising is crucial to build brand awareness of Macmillan Cancer Support, which uses case study-led content in its pre-roll ads.

Digital marketing manager Richard Thurston says the charity is a big user of Google Preferred, which enables advertisers to reserve inventory from popular YouTube channels. “It means we get more click-throughs and longer dwell times,” he says. “Ultimately, one man’s premium inventory is another man’s non-premium. If premium is not available to buy, we still get value from other video inventory that is available.”

He claims video advertising does not work as well on fundraising campaigns. “We have noticed that we might get a lot of views but the numbers signing up for an event or to donate do not go up.”

But for Macmillan the return it gets from video advertising justifies the production costs. “We produce a lot of content, not just for marketing, though it does make good marketing material to help us convey our message in an engaging way.”

As audiences have transitioned from traditional media to desktop and now mobile, the concept of premium becomes subjective and more difficult to define, because it ultimately comes down to ability to target and engage with audiences.

There are, of course, attributes that would mark out a publisher’s video inventory as superior. These include the quality of the content, how engaged the audience is with that content, and whether that audience is addressable.

The future of video advertising is on mobile, where we see new players thriving because they’re not shackled by the traditional publishing model. They have the ability to be more agile and therefore improve the advertising experience.

There will be huge demand over the next couple of years from brands for more premium mobile video, so all publishers need to adapt. More of us are choosing to view content on mobile devices because screen size is no longer an issue. We also love the swipe and touch technology that is being adopted by publishers and brands trying to reach us.

Consumers understand the value exchange for advertising if they are to receive free premium content. Results from our recent ‘What’s My Worth?’ survey of over 4,000 consumers found that 79% understand and accept this paradigm. What they do demand, however, is that the ads they receive are of a high quality, relevant and targeted to them. The challenge for publishers is how best to integrate mobile video advertising without detriment to the user experience. Consumers do not, for instance, want to sit through lots of pre-roll video ads before watching a 30-second news clip.

We have launched our mmSDK 6.0 software development kit, which enables publishers who have not been able to off er mobile video in the past to do so. Companion banners within the content host a small video lightbox, which uses native mobile functionality such as swipe, touch and sound for interaction. Once touched by a consumer, the video expands and can play in either a vertical or horizontal format.

Enabling publishers that were previously unable to run mobile video to do so, whilst maintaining a great consumer experience, will be a key driver of premium video inventory. It will also give marketers a broader source of inventory, creating the ability to target audiences and serve video ads around content deemed appropriate for brands.