Gimmick or game-changer? Behind the hype of Bitcoin and blockchain

Bitcoin’s crash risks consigning cryptocurrency to history as a gimmick, but some brands are realising its long-term potential and that of the blockchain technology behind it.

Whether you see the world of cryptocurrencies as a volatile speculator’s market or the new model for a decentralised economy, brands from Kodak and Burger King to startups in the loyalty and betting categories are all exploring the possibilities they offer.

Cryptocurrencies and the technology that enables them to exist, blockchain, are described at one extreme as gimmicks that simply make good fodder for PR stunts, and at the other as a new economic paradigm. So which is it?

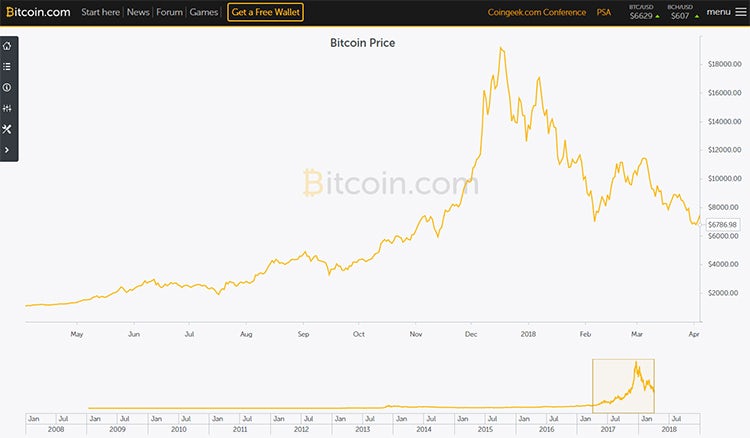

Bitcoin has been hitting headlines since December, when its value surged to $18,700 (£13,386) per coin following the opening of the first Bitcoin futures market on the Chicago Board Options Exchange. To put this into context, Bitcoin was valued at just $966 (£619) at the start of 2017. The price has now slipped back to $6,602 (£4, 714), leaving the market open to accusations of dangerous volatility.

Cryptocurrencies plug into the power of blockchain, which enables organisations and supply chains to record data in a highly secure and fully verifiable fashion, without any one party being in control. Blockchain tech is based on the concept of an open ledger, which allows anyone in a community to validate the transactions taking place within it, explains Jascha Kaykas-Wolff, CMO at internet company Mozilla.

It also has many more – and potentially much more useful – applications than just cryptocurrency, which is the one gaining most attention.

“If we built an ad network that used blockchain as the tool that could validate that the ads were shown to people, you could effectively try to eliminate ad fraud.”

Brands will increasingly be drawing on blockchain technologies to prove the authenticity for the consumer.

Jeremy Bassinder, IBM iX

Over the past year, Kaykas-Wolff has seen more brands become interested in cryptocurrencies as a vehicle to fund their businesses. These ‘initial coin offerings’ (ICOs) encourage people to buy into cryptocurrencies or tokens, helping companies raise money in a way that circumvents traditional investment channels.

To drum up support for their ICOs many brands are cultivating communities on cryptocurrency-friendly messaging app Telegram, which is reportedly planning its own ICO later this year.

As well as using messaging apps to talk to the community, companies are publicising their ICOs with endorsements from industry insiders known as ‘blockchain influencers’ or celebrities such as Paris Hilton and Jamie Foxx. In August last year, for example, blockchain-powered market predictions website Stox.com teamed up with boxer Floyd Mayweather to promote its ICO.

Yet despite the growing buzz around ICOs, the blacklash has been swift. Last month, Google updated several policies to ban ads promoting unregulated, overly complex or speculative financial products including cryptocurrency.

That followed Facebook’s announcement in January that it would block all ads promoting cryptocurrency products and services. The new rules mean that ads cannot encourage users to buy Bitcoin tokens or get involved in an ICO on either platform.

Facebook argues that many companies are “not acting in good faith”, hoping to capitalise on Bitcoin’s recent rise in value. Facebook’s decision to ban crypto adverts caused Bitcoin’s share price to fall by more than 10%, with a similar collapse seen after Google’s announcement. Twitter has also followed suit.

Another prominent Bitcoin detractor is Berkshire Hathaway CEO and serial investor Warren Buffett, who in January proclaimed that cryptocurrencies would “come to a bad ending”. Then in early March, governor of the Bank of England, Mark Carney, said the bank had no use for the technology underpinning cryptocurrencies and that they were unlikely to be “the future of money.”

Other financial brands are attempting to limit their exposure if the Bitcoin bubble bursts. On 5 February, Lloyds Banking Group banned eight million credit card customers across its Lloyds Bank, Bank of Scotland, Halifax and MBNA brands from buying Bitcoin on their cards following a sharp fall in the digital currency’s value.

READ MORE: Why marketers need to get to grips with blockchain

The cryptocurrency hype continues

Not all brands, however, are shying away from the cryptocurrency and blockchain hype. Amazon is reportedly developing a crypto-coin, while in January Starbucks CEO Charles Schultz mused about the possibility of integrating blockchain technology into the coffee chain’s mobile app.

Coca-Cola is keen to explore the potential of blockchain through its collaboration with the US State Department on a highly secure register for workers, aimed at combating the use of forced labour globally.

The travel sector has embraced Bitcoin with vigour. Expedia and Latvian airline AirBaltic have accepted payments via Bitcoin since 2014, while Singapore Airlines plans to introduce a blockchain-powered frequent flyer app this summer.

Burger King Russia rolled out its own cryptocurrency, WhopperCoin, in August 2017. Customers are able to claim one coin for every rouble spent on a Whopper, and amassing 1,700 WhopperCoins will buy diners another burger. The coins, which are collected by scanning the customer’s receipt with their smartphone, can also be traded via a peer-to-peer exchange.

If we built an ad network that used blockchain as the tool that could validate that the ads were shown to people, you could effectively try to eliminate ad fraud.

Jascha Kaykas-Wolff, Mozilla

Meanwhile in January, camera company Kodak launched KodakOne, an image rights management platform using blockchain to create an encrypted, digital ledger of rights ownership for photographers, to register both new and archive work.

The photography is licensed within the KodakOne platform, which detects any unlicensed use of imagery. When the photographer’s work is licensed, they receive immediate payment via Kodak’s cryptocurrency, KodakCoin.

News of Kodak’s decision to venture into the crypto-world saw the company’s share price more than double on 9 January. The brand was, however, forced to postpone its ICO a day before the scheduled launch on 31 January in order to evaluate the status of the 40,000 potential investors who had applied to take part.

Although these big brands are capitalising on the blockchain buzz, some early adopters have been accused of trading off the cryptocurrency hype. Take beverage company Long Island Iced Tea Corp, which in December saw its share price jump 432% after deciding to change its name to Long Blockchain Corporation.

Kaykas-Wolff sees a “fascinating ancillary interest in cryptocurrency” emerging, with brands jumping on the Bitcoin bandwagon as a gimmick or PR stunt.

“I would love to say that brands are much more evolved in their thinking around cryptocurrency and blockchain in particular [than a year ago], but I just don’t think it’s a true statement,” he says.

“There’s still very much a struggle with: how can I find a [way] into this new and emerging world using decentralised technologies like blockchain? But also, how do I think about cryptocurrency in terms of how it relates to my business?”

We are on a continuum, says Kaykas-Wolff, with investment in niche blockchain systems at one end and at the other businesses using cryptocurrencies or ICOs as a marketing tactic to increase awareness.

“At some point, we need to find ourselves in the middle where it isn’t a gimmick and it’s not just some potentially interesting technology,” he adds.

“There are a lot of experimental ideas that are trying to be applied, but they have got a long way to go before they are mainstream. The reality is blockchain needs bigger organisations with lots of users start to show real consumer value.”

Blockchain’s true potential

There are those who describe the era of blockchain and cryptocurrency as a shift into a new economic paradigm. Jeremy Epstein, CEO at blockchain startup agency Never Stop Marketing, calculates the blockchain marketing tech landscape has grown by 400% in the past year, a large proportion of which has been in the areas of advertising and loyalty.

Epstein recognises that we are early in the adoption of blockchain technologies, likening it to the development of the internet in 1992 and the fact internet adoption didn’t intensify until 1999. He argues that although blockchain may still be an immature market, it is better to get ahead than get caught behind.

“You’re not going to move your entire advertising spend over to this tomorrow, that’s absurd, but what you should be doing is deploying some of the marketing technology and asking your digital marketing managers to go and figure this stuff out,” says Epstein.

“My message to brands is: this is going to affect you. If you don’t believe blockchain is going to affect marketing, imagine yourself in 1993 coming to me and saying: is this internet thing going to affect marketing? It’s going to affect everything.”

One concrete application for blockchain technology is tackling inefficiencies in the digital advertising ecosystem, creating greater transparency and building trust.

“[Procter & Gamble chief brand officer] Marc Pritchard is basically saying this thing’s a disaster; we need to end the Mad Men era of advertising,” says Epstein.

“[His demands are] basically a requirements checklist for a decentralised advertising technology solution. The guy is basically begging for blockchain, he just doesn’t realise it yet.”

READ MORE: P&G’s Marc Pritchard calls for an end to the ‘archaic Mad Men model’

P&G rival Unilever has already teamed up with IBM on a new blockchain project to investigate how to drive digital ad transparency.

Jeremy Bassinder, IBM iX leader for consumer products, retail, and travel and transport, explains the goal is to open up the world of programmatic advertising to see where the money actually goes.

If you don’t believe blockchain is going to affect marketing, imagine yourself in 1993 and saying: is the internet going to affect marketing?

Jeremy Epstein, Never Stop Marketing

“It’s not necessarily to say that anybody is doing anything untoward, but let’s have visibility of it and then let’s agree that we’re measuring things in a consistent manner, so when you say that an ad has been viewed I agree it has been viewed in the same way,” he explains.

“We’re now evaluating the success of what has been built. Then I suppose it’s where you go next, because ultimately there’s going to have to be an industry-wide adoption of it at some point.”

The blockchain technology involved in this project would enable advertisers and media owners to engage in a smart contract, whereby all parties agree a position on whether a transaction is taking place and the amount of value being transferred, reducing the risk of dispute.

Any changes made to the smart contract would have to be agreed by all the parties before they could be applied across the blockchain.

Going forward, Bassinder sees smart contract specialists working in procurement departments, programmatic advertising, trade promotions and even in supply chain operations.

“You could see it at the other end of the spectrum on the supply side if you’re procuring services or products. I can totally see it transforming the way traceability and authenticity of products works,” says Bassinder.

“Brands will increasingly be drawing on blockchain technologies to prove the authenticity for the consumer. It’s very early days, but I can only see this growing exponentially over the next few years.”