Gender stereotypes, Brexit concerns, client-agency relationships: 5 killer stats to start your week

We arm marketers with all the numbers they need for the week ahead.

1. Children exposed to fewer age-restricted TV ads

Children’s exposure to TV ads for alcohol, gambling and food and soft drink products high in fat, salt or sugar (HFSS) is declining.

Data from 2017 indicates children see an average of 161.2 TV ads per week, of which: one is for an alcohol product; 2.8 are for gambling products; and 9.6 are for HFSS products. That means alcohol ads make up just 0.6% of all TV ads children saw in 2017, while HFSS ads make up 6%.

Children’s exposure to TV ads peaked in 2013 at 229.3 ads per week and has since fallen by 29.7%. Exposure to TV ads for alcohol decreased by 62.5%, gambling ads by 37.3% and HFSS ads by 45.5%.

Source: ASA

2. Brexit tops consumers concerns over personal finance and job security

Almost half (48%) of consumers say ‘Brexit’ is their biggest concern in 2019, followed by ‘a weaker economy’ cited by 13% and ‘lack of savings’ by 12%.

Some 41% of consumers expect their personal finances to weaken in 2019. To cope with this, 35% of respondents say they will spend less on experiences such as eating out, going to the cinema and bowling in 2019, compared to 17% who say they will spend more.

Almost a third (29%) of the least affluent households are concerned about repaying their credit card debt heading into 2019. This figure falls to 14% for the wealthiest households.

Overall, 37% of respondents believe their assets, such as house prices, are likely to become weaker this year.

Source: NatWest and Retail Economics

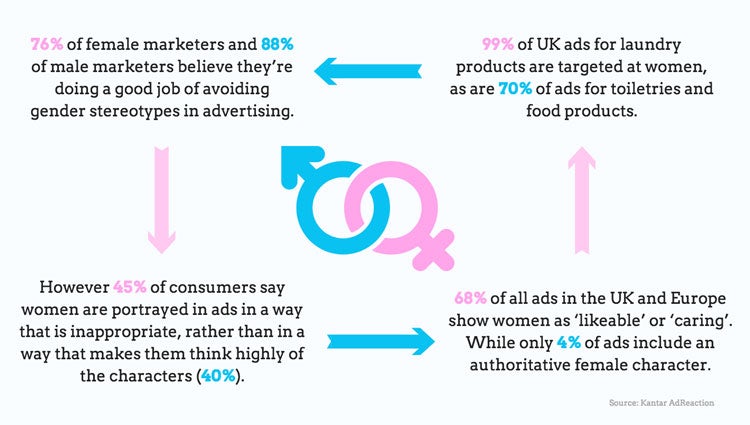

3. Advertisers and consumers clash over gender stereotypes

The majority of marketers believe they’re avoiding gender stereotypes but consumers think advertisers are missing the market.

Some 76% of female marketers and 88% of male marketers believe they’re doing a good job of avoiding gender stereotypes in advertising. However almost half (45%) of consumers say women are portrayed in ads in a way that is inappropriate, rather than in a way that makes them think highly of the characters (40%).

This gap is even wider for male portrayals at 44% and 35% respectively.

In the UK, when both genders appear in an ad, they are likely to be equally featured, indicating the UK is more progressive in its representations compared to the global average where men are 38% more likely to be featured prominently than women.

However, gender portrayals remain stereotyped, with 68% of all ads in the UK and Europe showing women as ‘likeable’ or ‘caring’. While only 4% of ads include an authoritative female character, and 7% depict an authoritative man.

Almost all (99%) of UK ads for laundry products are targeted at women, as are 70% of ads for toiletries and food products.

Source: Kantar AdReaction

4. Changing payment methods could improve client-agency relationships

Most large companies believe taking a different approach to the way they pay their agency partners will improve the relationship.

Some 71% of brands agree with the statement ‘I feel that changing my current agency remuneration models would improve the relationships that I have with my agencies’. And 81% of respondents expect a shift towards performance-based remuneration models with a focus on outcomes.

The number of companies currently using output-based fees as the main corporate remuneration contract has climbed to 28%, up from 20% in 2011, while a further 15% combine performance with a labour-based payment, up from 9% in 2011.

Over the next 12 months, 81% of respondents plan to increase the prevalence of output, performance and value-based remuneration models.

Across all types of agencies, on average less than 20% of the total remuneration is linked to performance for 80% of the respondents. And for more than half of the respondents, less than 10% of remuneration is related to this.

Source: WFA

5. Global marketing industry worth more than initially thought

The global marketing industry is worth $1.7trn per year, higher than previous estimates which tend to peg the industry at around $1trn.

Paid media accounts for 37% of total expenditure, down from 42% in 2015. By contrast, spend has grown significantly in activities related to owned media, which was increased by 11% between 2015 and 2018, and marketing technology, which was up 25%.

The report forecasts that growth in the global marketing industry will slow to 1.4% between 2019 and 2021, down from the 3.3% growth experienced between 2015 and 2018.

Source: PwC & Redburn