How the rise of ‘posh’ burgers threatens fast food

Fast-growing chains such as Byron account for only a small market share among burger and chicken restaurants, but changing preferences and rising incomes could encourage more consumers to trade up from fast food brands such as McDonald’s.

The news this month that hamburger chain Byron is speeding its expansion could herald an era of dominance for the ‘posh’ burger. The company aims to open 15 new restaurants a year, founder Tom Byng told the Telegraph, up 50% from the figure of 10 a year reported just six months ago.

But despite the growth of such premium outlets, for the world’s biggest fast food company, McDonald’s, the UK is one of the few countries to have bucked a global downward trend, delivering 37 consecutive quarters of sales growth to date. Global sales, which have been on the slide at the company for more than a year, fell by 0.7% in the second quarter of 2015 as McDonald’s reported “negative guest traffic in all major segments”.

British CEO Steve Easterbrook, who took the helm in January, has attributed the UK business’s anomalous performance to its “customer-centric” strategy. It also reflects a sector that is booming across the country.

The market for chicken and burger restaurants in the UK is expected to continue growing strongly this year, according to new data from market research group Mintel. However, its report identifies numerous threats on the horizon, noting that rising competition from new operators, changing consumer behaviour and concerns over health and food provenance are trends that could shape the market in the years to come.

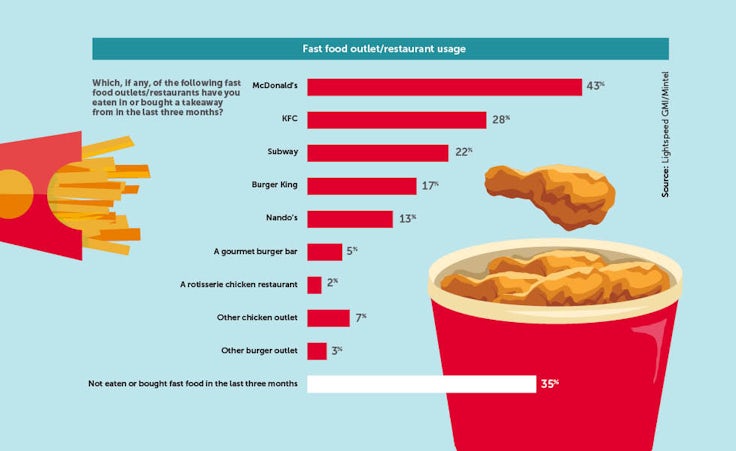

Growth of 5% is forecast in 2015, taking total market value to £4.7bn. This amounts to 23% growth between 2010 and 2015. McDonald’s is by far the most popular option for UK consumers, according to a survey of 2,000 adults for Mintel’s report, with 43% stating that they have eaten at one of its restaurants in the past three months. This is followed by KFC (28%), Subway (22%), Burger King (17%) and Nando’s (13%). The ‘Gourmet burger bar’ option, which refers to smaller, upmarket chains such as Byron, Gourmet Burger Kitchen and Haché, is selected by 5% of respondents.

Mintel also notes that some of the country’s biggest chains are seeking to innovate in their marketing and customer propositions in order to strengthen their market position in the UK. Burger King, for example, began trialling a home delivery service at eight of its UK restaurants in February, while McDonald’s began offering a table service at selected restaurants last month. The chain also began a roll-out of touchscreen ordering kiosks in 2014.

The survey shows that 52% of people are interested in ordering home delivery from a fast food outlet. Meanwhile, 34% of respondents either agree or strongly agree that they would prefer to place an order in a fast food restaurant via an electronic device than order at the counter.

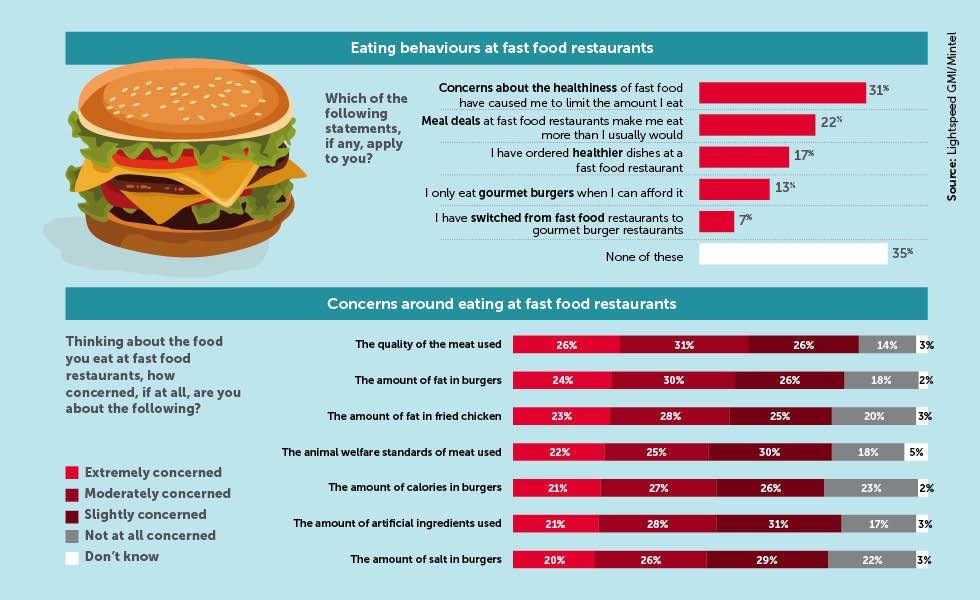

Despite these innovations, large operators are still likely to struggle with the impact of changing consumer behaviours and emerging demographic trends. For example, while just 7% of fast food outlet users agree that they have switched their allegiance to gourmet burger restaurants, this figure rises to 12% among 16- to 34-year-olds, the core fast food user group. Average income growth and the continued expansion of gourmet chains also increase the likelihood that more people will abandon fast food chains.

Several US premium burger chains have launched in the UK in recent years, including Smashburger, Shake Shack and Five Guys.

Mintel’s senior food and drink analyst Richard Ford says: “Rising real incomes could pose a challenge for the market by encouraging trading up. Innovation in store and menu design remain key to retain users’ interest.”

Health concerns are another factor, with 31% of fast food diners stating that they have cut down the amount they eat in fast food restaurants in order to reduce their fat intake. Only 17% have ordered healthier dishes at a fast food restaurant. According to Ford, this highlights a need for operators to make healthier alternatives more enticing.

When asked what they would be most interested in trying at a fast food restaurant, the most popular answer among respondents (29%) is ‘burgers containing thicker meat’. ‘A greater selection of burger toppings’ (26%) and ‘burgers made with more premium bread’ (24%) also perform strongly.

As part of his turnaround plan, Easterbrook has introduced a trial of high-end sirloin burgers at certain McDonald’s restaurants. He has also spoken of the need for “progress over perfection”, suggesting an awareness that the market will remain challenging for some time. The challenges are likely to include much greater competition from posh burgers in the UK.