Adidas details ‘revolutionary’ three-pillar strategy as it aims to reclaim lost ground

Adidas is focusing on ad spend and a closer relationship with celebrities such as Kanye West as it provides greater details on its strategy through to 2020.

Adidas, which first introduced its three-pillar marketing strategy in March 2015, has today (19 July) outlined its plans in greater details in a meeting with investors.

A focus on speed

The German sports giant told investors 50% of its sales will be through speed-enabled products by 2020.

Adidas defines speed-enabled as a complete “reshaping” of its entire business model, from range planning to product creation, sourcing, supply chain, go-to-market and sales, as it looks to “significantly improve its speed-to-market.”

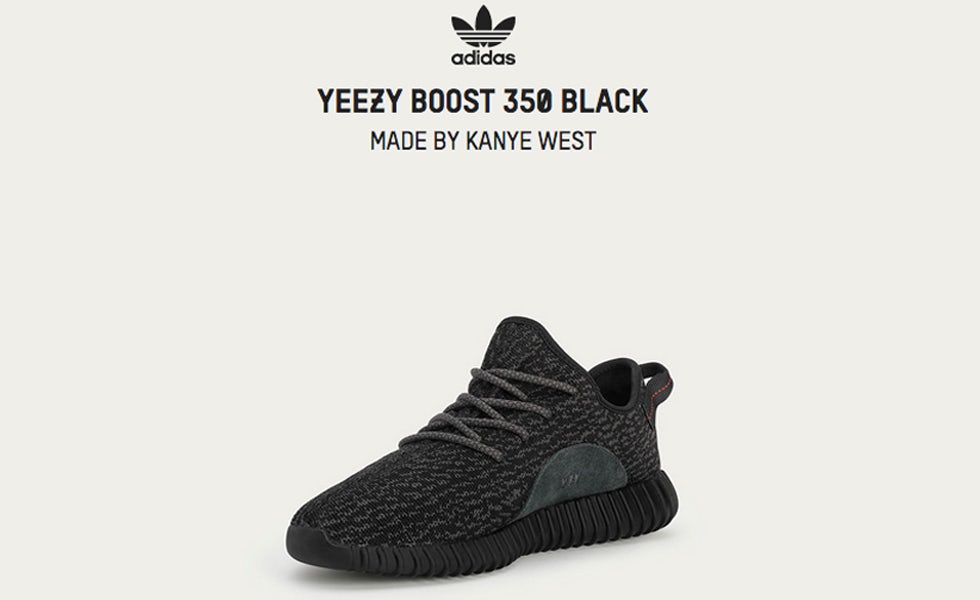

This essentially means Adidas will aim to more quickly replenish the stock of seasonal best-sellers – such as Kanye West’s Yeezy line, which has at times struggled to meet huge consumer demand – to fulfil buzz and improve its ability to tap into emerging trends. As a result of these changes, Adidas says its share of full-price sales across the speed ranges will improve by 20% over the next five years.

“Our goal is to give consumers what they want when they want it. Speed is one of the most powerful levers for our Group to do so. It will change the way we create, manufacture and distribute our products. It will revolutionise our current business model,” says Franck Denglos, vice-president of Adidas’ speed division.

“Speed will be a key competitive advantage for us as we transform the Adidas Group into the first true fast sports company.”

The efforts are part of Adidas’ wider Speedfactor initiative, which aims to stop with centralised production of products, such as shoes, and instead produce them closer to the consumer’s location. It is hoping this will result in more personalised products.

Focusing marketing on six cities

Adidas also outlined the logic behind its plans to focus its marketing efforts on six major global cities: New York, Shanghai, Paris, Tokyo, Los Angeles and London.

It said the plans make sense because 50% of the global population currently live in cities and 80% of global GDP is generated in metropolitan areas.

The German brand said that up until 2020 it will “disproportionately” invest marketing and retail experiences within these six cities as it aims to outperform its rivals in terms of market share and brand advocacy.

“The influence of global metropolitan areas on trends and brands cannot be overstated. The fate of global brands is decided in global cities. If we want to be successful in the future, we need to win in key cities,” explained Christopher Williams, vice-president of commercial planning and development.

“Our focus on key cities enables us to activate our categories in the right areas and engage with communities in the most relevant neighbourhoods. And this then filters down to the rest of the countries.”

A closer relationship with celebrities

A lot has been said about Adidas’ work with controversial rap superstar Kanye West, but last month Adidas extended the collaboration with the announcement of a new fashion line that will be the biggest partnership Adidas has ever launched with a non-athlete.

And Adidas has pledged to build a wider collaborative network with famous athletes, creatives, consumers and other partners as it aims to “help shape the future of sport and sports culture”.

It said it will provide collaborators with access to internal tools, including access to its archive, materials, factories and data.

“We are the first sports company that invites athletes, consumers and partners to be part of our brand,” adds James Carnes, VP of brand strategy creation.

“Our portfolio of creative influencers and innovative partners such as Kanye West, Stella McCartney, Disney, Parley for the Oceans, Red Bull Media House, BASF and Google offers incredible opportunities for us to leverage our brands, showcase our creative potential and inspire consumers more than any other sports company. Together, we will co-create the future of sports.”

A new direction for Adidas

Adidas is hoping the changes will help it recapture lost ground in North America, where it currently sits behind both Nike and relative newcomer Under Armour.

At the start of the year, it appointed a new chief executive in Kasper Rorsted, who is set to join fully in October.

Tim Crow, CEO of Synergy Sponsorship, has expressed doubts to whether its focus on cities will work as he speculated whether Rorsted might seek to change things come October.

“You have to question the logic behind some of this city-focused stuff as global distribution is one of the biggest reasons Nike outperforms Adidas,” said Crow.

“Concentrating on big cities and creating a ‘new marketing organisation’ is a good sound bite but whether it truly works to drive profitability – which is the main reason Rorsted has been brought in, his skills at driving the bottom line – is another question. I imagine come October, Rorsted will take a long hard look and set out to review the marketing strategy altogether.”